UNSTABLE STABLECOIN What. A. Week. TerraUSD (UST), a cryptocurrency designed to always be worth $1, lost its peg to the dollar, falling to as low as 13 cents. UST's sister asset, LUNA, worth $119.22 at its peak collapsed to almost $0 on Thursday. As of Friday morning, the token's market capitalization stands at less than half a million dollars—a dramatic fall from $28 billion just a week ago.

So, what happened?

Last weekend, UST started to deviate from the peg as macro uncertainty continued to mount in light of the Fed's 50bps interest rate increase and plunges in both stock and cryptocurrency markets. Investors' loss of confidence in the asset appears to have triggered billions in withdrawals from the Anchor Protocol, a lending market that offered yields as high as 20% to users who deposit UST.

Conspiracy theories started to spread like wildfire. The most popular rumor claimed that asset manager BlackRock and hedge fund giant Citadel Securities jointly borrowed 100,000 bitcoin (worth about $3 billion at current prices) from cryptocurrency exchange Gemini to purchase UST, only to dump it later causing the market to collapse. All three companies denied their involvement.

The Terra blockchain, which supports UST and LUNA, halted twice on Thursday as the entities responsible for verifying transactions on the blockchain were looking to "come up with a plan to reconstitute" the network. Binance, the world's largest crypto exchange, suspended spot trading for LUNA and UST against its own stablecoin BUSD.

"In just a couple of days, the cryptocurrency market lost $300 billion in market capitalization. In total, the cascading liquidations wiped away almost $1 trillion worth of value in a month. Additionally, the world's largest stablecoin and a centerpiece of global cryptocurrency trade, Tether, which unlike Terra claims to back its tokens with actual dollar reserves, also slipped away from its $1 peg on Thursday."

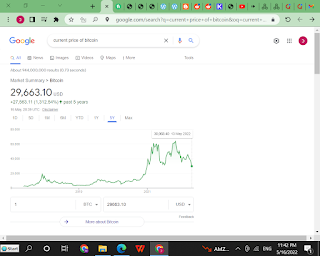

On Friday morning, cryptocurrencies started to recover, with bitcoin returning to the $30,000 mark and ether and other heavyweights posting double-digit percentage gains. |

COINBASE'S TOUGH QUARTER Shares of Coinbase Global (COIN), the largest cryptocurrency exchange in the U.S., plunged more than 20% on Wednesday morning to approximately $56 after the company reported its first quarterly loss amidst declines in revenue and trading volume. The firm's first-quarter revenue slumped to $1.17 billion, below Wall Street's expectations of $1.48 billion. The exchange's total trading volume shrank from $547 billion in the fourth quarter of 2021 to $309 billion. Following the earnings release, several investment firms cut their price target on Coinbase's stock but maintained their "buy" ratings and expressed confidence in the company's long-term success. In a notable exception, Goldman Sachs downgraded it from "buy" to "neutral," lowering its 12-month target for the stock from $240 to $80. As of early Friday, COIN has recovered and is trading at $72.56. |

| The True Value Of Cryptocurrencies The geopolitical strife taking place in Ukraine has once again underlined the true value proposition of digital currencies that are secure, censorship resistant and easily transportable. To get in-depth research, interviews, trading signals and other valuable information unavailable anywhere else subscribe to Forbes CryptoAsset & Blockchain Advisor. |

|

BLOCKCHAIN 50 SPOTLIGHT FTX: Led by 29-year-old Sam Bankman-Fried, the world's richest crypto billionaire (net worth: $21.2 billion), FTX dominates the hypercompetitive crypto exchange landscape. It handles some 10% of the $3.4 trillion face value of derivatives (mostly futures and options) traded by crypto investors each month. FTX pockets 0.02% of each of those trades on average, good for around $750 million in nearly risk-free revenue—and $350 million in profit. Additionally, the company hauled in a record $1.5 billion in private funding last year, rocketing its valuation from $1.2 billion to $25 billion. Eager to become a household name, FTX is spending hundreds of millions of dollars on marketing, signing up a slew of celebrity brand ambassadors including Tom Brady, David Ortiz and Kevin O'Leary. |

| ELSEWHERE Terra Disaster Fuels Congressional Work On Stablecoin Legislation [The Block]

FTX Founder Sam Bankman-Fried Buys 7.6% Stake in Robinhood [The Wall Street Journal]

Nomura Starts Trading Crypto Derivatives, Joining Rivals Goldman, JPMorgan [CoinDesk] |

Nina Bambysheva Nina Bambysheva

Reporter

Forbes Money & Markets |

| Follow us on Twitter & Facebook |

|

|

No comments:

Post a Comment