https://get.wolt.com/3Z9B7AD

a place to find out about how to live well, blog about trends and find the best roast of coffee in the world for your daily consumption

Search This Blog

Translate

eBay Linking EPN

Wednesday, May 18, 2022

Get Wolt and use the code 3Z9B7AD to get ₪15 off for each of your first 2 delivery orders!

https://get.wolt.com/3Z9B7AD

Fwd: Google Alert - nft

| | |||||

| nft | |||||

| NEWS | |||||

| Niftables Announces Its Groundbreaking All-in-one NFT Platform for Brands and Creators At the heart of the platform is the $NFT token, which will serve as the primary payment method throughout the broader Niftables ecosystem.

| |||||

Monday, May 16, 2022

Moving from self-destruct to self-care | Mental Health Foundation

https://www.mentalhealth.org.uk/blog/moving-self-destruct-self-care

To your health you can find great deals on our website

more great links to check out when you get the chance

Dell Stock seems very stable right now

Re: Crypto’s $1 Trillion Meltdown | Worthless Stablecoin

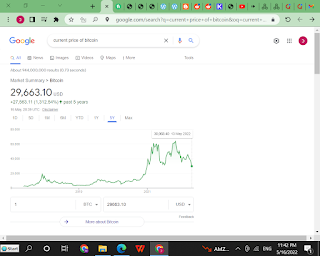

as you can see bitcoin is not dead and is not getting crushed like the market would make you believe that it is experiencing

What. A. Week. TerraUSD (UST), a cryptocurrency designed to always be worth $1, lost its peg to the dollar, falling to as low as 13 cents. UST's sister asset, LUNA, worth $119.22 at its peak collapsed to almost $0 on Thursday. As of Friday morning, the token's market capitalization stands at less than half a million dollars—a dramatic fall from $28 billion just a week ago.

So, what happened?

Last weekend, UST started to deviate from the peg as macro uncertainty continued to mount in light of the Fed's 50bps interest rate increase and plunges in both stock and cryptocurrency markets. Investors' loss of confidence in the asset appears to have triggered billions in withdrawals from the Anchor Protocol, a lending market that offered yields as high as 20% to users who deposit UST.

Conspiracy theories started to spread like wildfire. The most popular rumor claimed that asset manager BlackRock and hedge fund giant Citadel Securities jointly borrowed 100,000 bitcoin (worth about $3 billion at current prices) from cryptocurrency exchange Gemini to purchase UST, only to dump it later causing the market to collapse. All three companies denied their involvement.

The Terra blockchain, which supports UST and LUNA, halted twice on Thursday as the entities responsible for verifying transactions on the blockchain were looking to "come up with a plan to reconstitute" the network. Binance, the world's largest crypto exchange, suspended spot trading for LUNA and UST against its own stablecoin BUSD.

"In just a couple of days, the cryptocurrency market lost $300 billion in market capitalization. In total, the cascading liquidations wiped away almost $1 trillion worth of value in a month. Additionally, the world's largest stablecoin and a centerpiece of global cryptocurrency trade, Tether, which unlike Terra claims to back its tokens with actual dollar reserves, also slipped away from its $1 peg on Thursday."

On Friday morning, cryptocurrencies started to recover, with bitcoin returning to the $30,000 mark and ether and other heavyweights posting double-digit percentage gains.

Shares of Coinbase Global (COIN), the largest cryptocurrency exchange in the U.S., plunged more than 20% on Wednesday morning to approximately $56 after the company reported its first quarterly loss amidst declines in revenue and trading volume. The firm's first-quarter revenue slumped to $1.17 billion, below Wall Street's expectations of $1.48 billion. The exchange's total trading volume shrank from $547 billion in the fourth quarter of 2021 to $309 billion. Following the earnings release, several investment firms cut their price target on Coinbase's stock but maintained their "buy" ratings and expressed confidence in the company's long-term success. In a notable exception, Goldman Sachs downgraded it from "buy" to "neutral," lowering its 12-month target for the stock from $240 to $80. As of early Friday, COIN has recovered and is trading at $72.56.

The True Value Of Cryptocurrencies

Get Forbes CryptoAsset & Blockchain Advisor

FTX: Led by 29-year-old Sam Bankman-Fried, the world's richest crypto billionaire (net worth: $21.2 billion), FTX dominates the hypercompetitive crypto exchange landscape. It handles some 10% of the $3.4 trillion face value of derivatives (mostly futures and options) traded by crypto investors each month. FTX pockets 0.02% of each of those trades on average, good for around $750 million in nearly risk-free revenue—and $350 million in profit. Additionally, the company hauled in a record $1.5 billion in private funding last year, rocketing its valuation from $1.2 billion to $25 billion. Eager to become a household name, FTX is spending hundreds of millions of dollars on marketing, signing up a slew of celebrity brand ambassadors including Tom Brady, David Ortiz and Kevin O'Leary.

FTX Founder Sam Bankman-Fried Buys 7.6% Stake in Robinhood [The Wall Street Journal]

Nomura Starts Trading Crypto Derivatives, Joining Rivals Goldman, JPMorgan [CoinDesk]

Nina Bambysheva

Reporter

Forbes Money & Markets

Fwd: Google Alert - nft

| | |||||||

| nft | |||||||

| NEWS | |||||||

| Pioneering Audio Art NFT Project Featuring Tom Hiddleston To Be Released - Forbes The Masters Audio Art Collection are a collection of artistic creativity transported into NFTs. The first feature of the collection is Marvel star ...

| |||||||

| Putting the Intangible into Your NFT Project - Entrepreneur Thousands of buyers are investing millions of dollars into non-fungible tokens (NFTs). While skeptics claim it's a fad, the vast volume of sales ...

| |||||||

| Arrest Video Shows Ezra Miller Claiming 'I Film Myself When I Get Assaulted for NFT Crypto Art' In a video of their March arrest in Hawaii, 'The Flash' actor Ezra Miller claimed they film clips when they're assaulted to sell as "NFT crypto ...

| |||||||

| New York City Climbers Are Selling NFTs to Finance a New Gym - Outside Online New York City Climbers Are Selling NFTs to Finance a New Gym. Chalk Plant hopes to raise funds through Web3 technology to build a climbing space ...

| |||||||

| Madonna breaks silence on getting ridiculed by internet over her NFT - The News International Madonna, who was recently ridiculed over her 'creepy' NFT videos, took the charge to defend the thought process behind the artistic expression of ...

| |||||||

Madonna hits back over X-rated new career move - News.com.au Madonna isn't hung up on criticisms about her body-baring NFT. ... Madonna reveals fully nude NFTs and a 3D model of her vagina.

| |||||||

| Madonna defends NFT featuring 3D-model of her vagina | indy100 Madonna, 63, has defended her nonfungible token (NFT) that features a 3D model of her vagina.The pop icon worked with the NFT artist Beeple to ...

| |||||||

| the tech bubble seems to have stopped bleeding - Search (bing.com) | |||||||

Sunday, May 15, 2022

Fwd: Crypto’s $1 Trillion Meltdown | Worthless Stablecoin

| |||||||||||||||||||||||||||||||||||||||||||||||||||||

Help Aharon Tzvi survive Pneumonia & a Heart Defect

Help Aharon Tzvi survive Pneumonia & a Heart Defect | The Chesed Fund https://thechesedfund.com/chesedprojects/351?aff=17